If you are concerned about a huge tax bill at the conclusion of the calendar year you can earn tax payments on your Social Security income throughout the year. Information about Notice 703 Read This To See If Your Social Security Benefits May Be Taxable including recent updates related forms and instructions on how to file.

Fillable Form 1040 Schedule C 2019 In 2021 Irs Tax Forms Credit Card Statement Tax Forms

The taxable portion of the benefits thats included in your income and used to.

Irs social security benefits worksheet 2019. Social Security Benefits WorksheetLines 20a and 20b - Form 1040 Instructions - HTML. If your railroad retirement benefits are exempt from tax because you are a resident of one of the treaty countries listed you can claim an exemption from withholding by filing Form RRB-1001 with the RRB. Annual Social Security benefit was 7500 and Carols was 3500.

Railroad Retirement Board RRB. 26 rows Social Security and Equivalent Railroad Retirement Benefits. Once completed you can sign your fillable form or send for signing.

The couples provisional income was 28000 pension plus interest plus half of each spouses Social Security benefits. Under the IRS rule their Social Security benefits are not. 501 Dependents Standard Deduction.

Tax from your benefits. 21 rows 2019 IRS Pub 915 Worksheet 1 Results. Also enter this amount on Form.

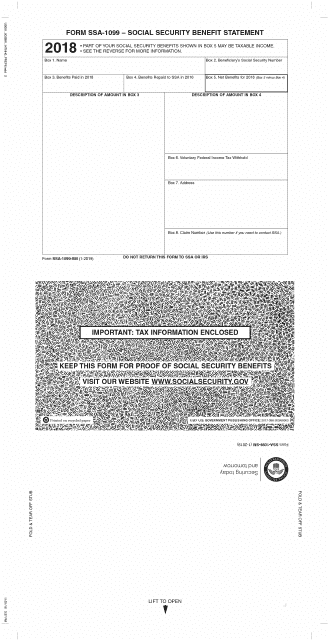

Social Security Worksheet 2019. The net amount of social security benefits that you receive from the Social Security Administration is reported in Box 5 of Form SSA-1099 Social Security Benefit Statement and you report that amount on line 6a of Form 1040 US. It is prepared through the joint efforts of the IRS the Social Security Administration SSA and the US.

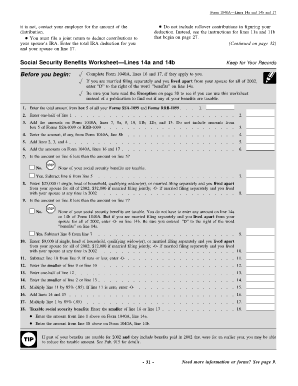

Start a free trial now to save yourself time and money. Form 1040 Social Security Benefits Worksheet IRS 2018. 3 Use the worksheet in IRS Pub.

Enter the total amount from box 5 of all your Forms SSA-1099 and Forms RRB-1099. The Form 1040 Social Security Benefits Worksheet IRS 2018 form is 1 page long and contains. Form 2555 Foreign Earned Income is being filed.

Tax Return for Seniors. Fill out securely sign print or email your 1040 social security worksheet 2014-2020 form instantly with SignNow. See IRA Deduction and Taxable Social Security on Page 14-6.

Internal Revenue Service Read This To See if Your Social Security Benefits May Be Taxable If your social security andor SSI supplemental security income benefits were your only source of income for 2020 you probably will not have to file a federal income tax return. Be sure you have read the Exception in the line 5a and 5b instructions to see if you can use this worksheet instead of a publication to find out if any of your benefits are taxable. 2 The taxpayer repaid any benefits in 2019 and total repayments box 4 were more than total benefits for 2019 box 3.

Was other income the software will complete the Social Security Benefits Worksheet found in the Form 1040 Instructions is completed by the software to calculate the taxable portion. On average this form takes 5 minutes to complete. For the 2019 and 2020 tax years single filers with a combined income of 25000 to 34000 must pay income taxes on up to 50 of their Social Security benefits.

This publication explains the federal income tax rules for social security benefits and equivalent tier 1 railroad retire-ment benefits. Some states tax Social Security benefits as a piece of income but others dont or only tax some of your benefits. Employers who withhold income taxes social security tax.

All forms are printable and downloadable. More specifically if your total taxable income wages pensions interest dividends etc plus any tax-exempt income plus half of your Social Security benefits exceed 25000 for singles 32000 for marrieds filing jointly and 0 for marrieds filing separately the. Available for PC iOS and Android.

If your social security benefits are exempt from tax because you are a resident of one of the treaty countries listed the SSA wont withhold US. If you file as an individual with a total income thats less than 25000 you wont have to pay taxes on your social security benefits in 2020 according to the Social Security Administration. Social Security Benefits Worksheet 2019.

Forms Instructions Internal Revenue Service May 1 2019 - Access printable electronic versions IRS forms including Form 1040 and Form 941 along with instructions and related publications. Year tax return information Income Social Security Benefits 9. Worksheet April 18 2019 1536.

Social security benefits include monthly retirement sur-. 915 if any of the following apply. Lump-Sum Benefit Payments.

None of the benefits are taxable for 2019. Many of those who receive Social Security retirement benefits will have to pay income tax on some or all of those payments. Complete this worksheet to see if any of your social security andor SSI supplemental security income benefits.

Tom also received a taxable pension of 22000 and interest income of 500. The most secure digital platform to get legally binding electronically signed documents in just a few seconds. Individual Income Tax Return or Form 1040-SR US.

Form 1040 Sr U S Tax Return For Seniors Tax Forms Irs Tax Forms Ways To Get Money

Fillable Form 2210 In 2021 Fillable Forms Financial Information Tax Forms

Pin By Lance Burton On Unlock Payroll Template Money Template Money Worksheets

Publication 590 A 2018 Contributions To Individual Retirement Arrangements Iras Internal Revenue Servic Social Security Benefits Irs Tax Forms Tax Forms

Safety Tracking Spreadsheet Small Business Tax Deductions Business Tax Deductions Spreadsheet Business

In A Comment Letter Sent June 13 2019 Roger Harris Expressed Concern That The New Requirements Placed On Employers P Federal Income Tax Lettering Employment

Form Ssa 1099 Download Printable Pdf Or Fill Online Social Security Benefit Statement 2018 Templateroller

Form 1040 Is One Of Three Irs Tax Forms Used For Personal Federal Income Tax Returns Filed With The Internal Revenue Irs Tax Forms Irs Taxes Federal Income Tax

Irs Releases New Not Quite Postcard Sized Form 1040 For 2018 Plus New Schedules Tax Forms Income Tax Irs Tax Forms

Irs Instruction 1040 Line 20a 20b Pdffiller

See The Eic Earned Income Credit Table Income Tax Return Income Federal Income Tax

F709 Generic3 Lettering Worksheet Template Profit And Loss Statement

Social Security Benefits Worksheet 2019 Fill Online Printable Fillable Blank Pdffiller

Printable 2019 Irs Form 1040 Us Individual Income Tax Return Cpa Practice Advisor

Here Are The New Income Tax Brackets For 2019 Cnbc 11 16 18 Tax Brackets Income Tax Brackets Income Tax

Notice 703 Fill Online Printable Fillable Blank Pdffiller

How And Why To Adjust Your Irs Tax Withholding Bankrate Com Irs Irs Taxes Bankrate Com

Irs Instruction 1040 Line 20a 20b 2014 2021 Fill Out Tax Template Online Us Legal Forms

Post A Comment:

0 comments: